This month we learned that Minnesota taxpayers have overpaid the state of Minnesota nearly $10 billion in taxes. Yet with this record budget surplus – a surplus that is projected to continue into the next biennium – Gov. Tim Walz and the DFL-controlled House of Representatives continue to deny our state has a tax problem.

Walz even had the audacity to propose sending every family a measly little “Walz check” from the surplus while reserving the bulk of the surplus for their progressive slush fund. Keep this in mind every time you fill your car with $4/gallon gasoline and buy your weekly groceries that have increased in cost 30-50 percent due to supply and labor issues locally, nationally, and globally and skyrocketing inflation as well: your family budget is strained by the highest rate of inflation for the past 40 years but the DFL state government budget knows no spending limits.

It shouldn’t be a surprise but other governors around the country are getting serious about cutting income taxes.

It shouldn’t be a surprise but other governors around the country are getting serious about cutting income taxes.

They recognize that life has changed rather dramatically during COVID and that a whole heck of a lot of people can work from home. And where home is matters: according to the Wall Street Journal, “In 2021, the 10 states that gained the most residents from domestic in-migration had an average total state and local tax burden as a percentage of income of 7.7%, notably lower than the 9.9% of the 10 states that lost the most residents.”

Minnesota remains an outlier with a top tax rate of 9.85% and we remain the sixth highest tax burden among the 50 states.

Eight states currently have no personal income taxes: Texas, Florida, Tennessee, Nevada, Wyoming, South Dakota, Washington and Alaska.

New Hampshire will become the ninth state to join this illustrious group and Mississippi (yes, that Mississippi) will become the 10th state! As of today, more than a dozen governors have introduced legislation that would lead their respective states towards that goal. These leaders have a sincere commitment to controlling state spending while they reduce tax burdens on their constituents. They understand that “there is a dramatic increase in tax competition to provide the best government at the lowest cost” and are doing their best to achieve that.

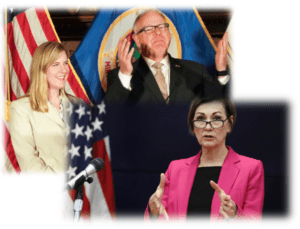

It’s even more important to note that two of the states that have adopted comprehensive tax reform are our neighbors: Iowa Governor Kim Reynolds has enacted a four-year plan to reduce the personal income tax rate to a flat 4% over the next four years.

Legislators in Wisconsin, with a “meager” $4 billion surplus, recently announced a bold plan to eliminate the state’s income tax but are appealing to voters to send a Republican governor to Madison next year to help them get the job done. And, of course, South Dakota is already without a personal income tax while North Dakota’s personal tax rate tops off at 2.9 percent.